AXIS - IT&T is a leading Engineering Design services provider, with over two decade's experience in delivering cutting-edge customer services to global clients. AXIS - IT&T provides comprehensive Engineering Design and Software Development services to its clients.

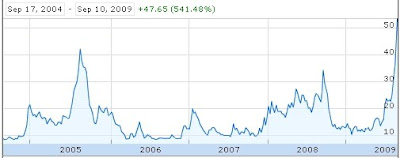

To start with recent movement of the stock looking at which many investors would have get lured.

This stock has shooted from 20 levels to 50 levels in hardly a months time. Why?

AXIS IT&T Ltd had announced the financial results for the quarter ended on 30-June-2009. The Net Sales was at Rs.301.02 lacs for quarter ended on 30-June-2009 against Rs.208.92 lacs for the quarter ended on 30-June-2008.

The Net Profit / (Loss) was at (Rs.50.81) lacs for the quarter ended on 30-June-2009 against (Rs.22.55) lacs for the quarter ended on 30-June-2008.

The company has reported an EPS of (Rs.0.25) for the quarter ended on 30-June-2009 against (Rs.0.11) for the quarter ended on 30-June-2008.

It had declared losses in this result and the same has been the rend for company for past few years. It is making losses continuously. Look at the important numbers.

Book value Rs. 8.83 against CMP:53

P/E Ratio 194 !! against insustry standard P/E of 19.

Nothing can justify a P/E of 194 for such a small cap stock. Not even an acquisition news (they acquired some company called Cades digitech) that has come out recently.

This is an operator played stock and I am sure it will cool off very soon since it had run a lot from 20 levels. DO NOT buy stocks of this company at this level. DO NOT enter in this trap at this moment.

I had recommended this stock, coincidentally, perfect an year ago, on 9th September 2008. Read the analysis here: Axis IT&T - Safe stock for investment - Multibagger?

Although the analysis done in this 1 year old article might give you a feeling of justification to current price of stock, but since the dynamics keep changing in the market scenarios and so I would recommend to not to buy stock at the moment. One may wait for a while to get it at right valuations.

Market Cap 112.68

* EPS (TTM) 0.29

* P/E 194.66

* P/C 77.33

* Book Value 8.83

* Price/Book 6.39

Div(%) 0.00

Div Yield(%) -

Market Lot 1.00

Face Value 5.00

Industry P/E 19.24