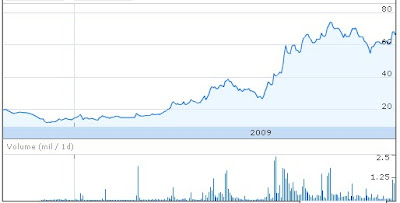

In July, the stock breached a key long-term key resistance at Rs 40 and later on it encountered resistance around Rs 75 in September recording a 52-week high. However, the stock witnessed a minor correction until it found support at Rs 55 and resumed its uptrend.

The stock broke through the corrective down trendline as well as 50-day moving average by gaining 10 per cent with heavy volume on November 24. With this the daily and weekly relative strength, indices have entered into the bullish zone. Signalling a buy, the daily moving average convergence and divergence indicator is heading towards the positive territory.

Short-term outlook on the stock is bullish. It’s uptrend is expected to prolong until it hits price target of Rs 75 in the forthcoming trading session. Stock Trader with a short-term horizon can buy stocks, while maintaining a stop-loss at Rs 64.50.

Short-term outlook on the stock is bullish. It’s uptrend is expected to prolong until it hits price target of Rs 75 in the forthcoming trading session. Stock Trader with a short-term horizon can buy stocks, while maintaining a stop-loss at Rs 64.50.Nirmal Bang stock research house has advised to buy and hold Eveready Industries with an investment view. The stock may touch target of Rs 76-91 as per their stock research.